The focus of the office has evolved: from property asset to people

In this, the hardest of all years for CRE, we are seeing real change in the way that clients view office space. Market demand is rapidly changing and the supply chain must evolve. Power is not in the property as an asset but with the people that use it.

Our 2021 Predictions explore what’s next for businesses and flexible office providers as we adapt to a post-pandemic world.

We have mirrored our predictions to the Darwinist theory of evolution by natural selection, which has five key stages – overproduction, adaptation, competition, variation and finally speciation.

Or, in other words, adapt or get left behind.

Read below for our full 2021 Predictions, or download a summary report here.

1. OVERPRODUCTION

The office sector has produced too much of one type of product

The corporate footprint of the future will be more dispersed and in diverse locations: demand in secondary and tertiary locations has increased under lockdown and we will see those markets produce a different level of quality and variety in workspace. The office market has only really offered clients the option to procure space on a long-term basis, and the design of this space has been very much one note. To match future demand, a new approach founded on a positive end-user experience will be required in a variety of locations.

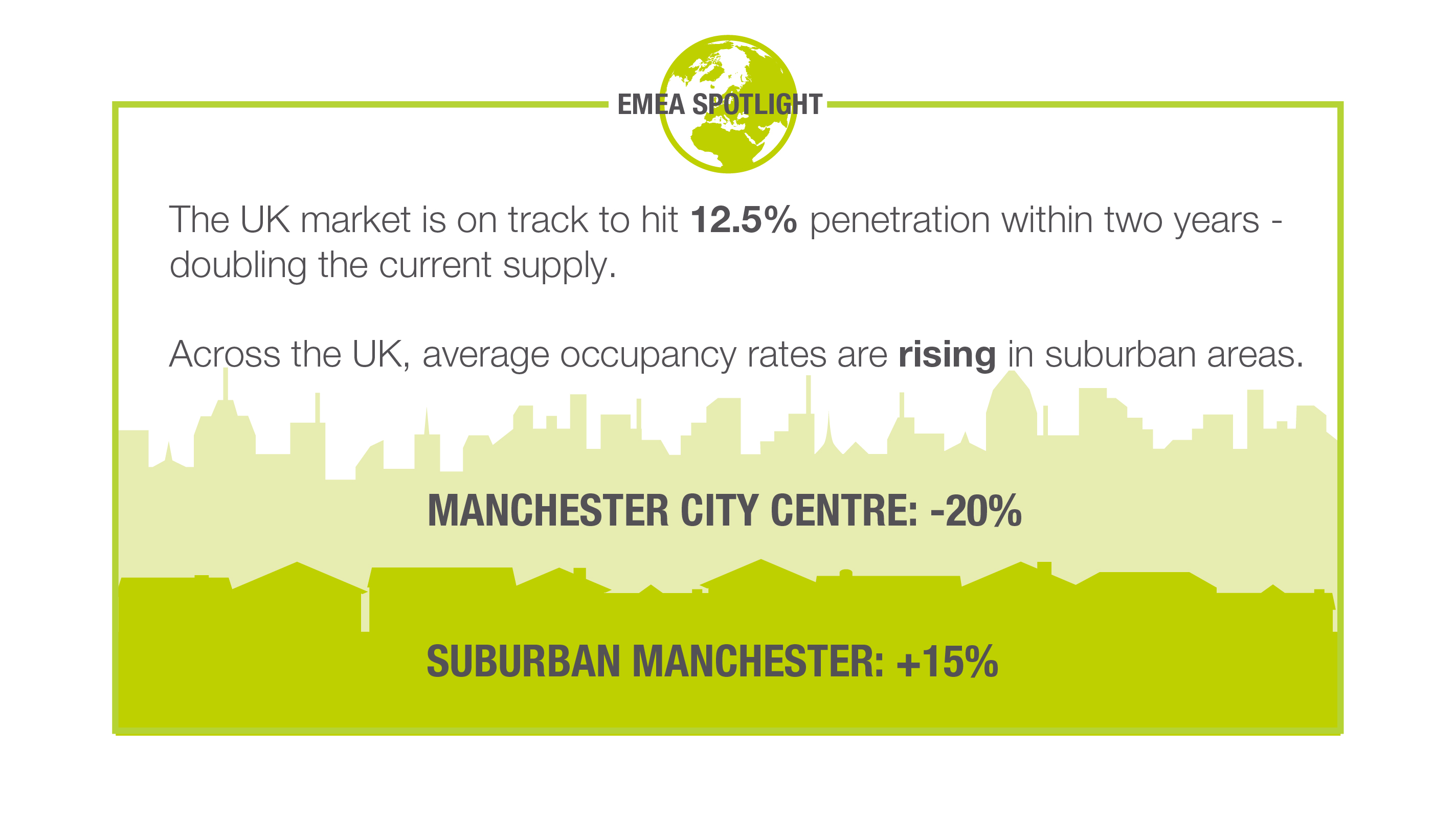

- Our data for flexible workspace already shows a distinct difference between the positive demand trends for suburban and rural locations compared to the negative or flat trends in city centers over the past 12 months.

- While many corporates are still analyzing their options, the next few years will be a period of trial and correction as businesses work to test new CRE strategies.

- What seems certain from conversations with both CRE and HR teams is that in many markets the employee will be fighting for more near-home workspace choice to reduce commute times and maintain work/life balance.

- Landlords and flexible workspace operators in these markets will have to produce more high quality office environments that match up to those of the city center markets.

- The demand for flexible workspace comes from two specific angles

- The SME-response: leaner, more agile businesses are taking regional space, moving their location, and tailoring their response to market conditions.

- The Corporate Response: wait and see as new business plans address the new business reality.

- The former is driving growth in the regions while the latter will see an initial dip in enquiries and then ramp up workspace demand as GDP growth returns.

Flex workspace is still less than 1% of the total global office market. An increase in demand for CRE clients looking to increase flex as a proportion of their portfolios will lead to landlords increasing flex provision and operators taking new approaches.

- Manhattan vacancy rates are currently at a 24-year record high with clients shedding space in most major markets. In New York City, Cushman & Wakefield reported that during Q3 demand remained weak across NYC but particularly in Manhattan. New leasing was 2.5m sq. Ft. down from a quarterly average of 8.7m sq ft. Only 3 large leases signed during the quarter far below expectations and normal trends. This has led to overall vacancy rates increasing by 140 basis points meaning vacancy currently sits at a 24 year high of over 13.3%.

- In Hong Kong, CBRE reports that transactions of large commercial spaces over 20,000 sq. ft are limited and downsizing seems to be the trend. Net absorption is down for the 4th consecutive quarter with Q3 data showing -500,000 sq. ft. This has caused vacancy rates to hit 7.8m sq ft, the highest it has been since 1999.

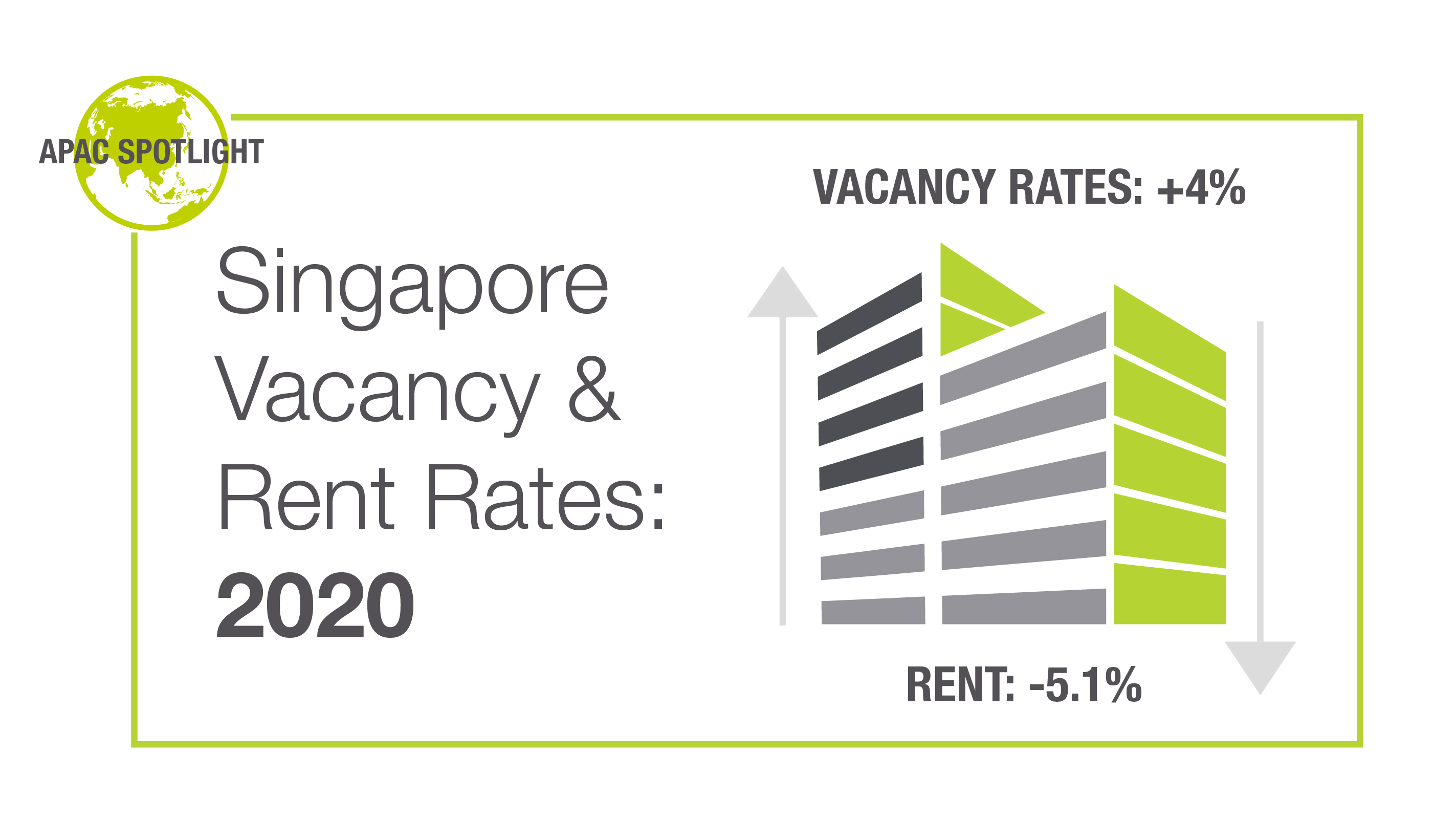

- Vacancy rates began to rise in Q1 for Singapore and have not stopped so far this year, presently sitting at just shy of 4%. This has impacted rents which have fallen by 5.1% quarter on quarter and could decline by as much as 10% by the end of the year. New supply onto the market is limited throughout 2021 and 2022 although the current pipeline shows huge amounts of new space due to come online in 2023 if the market has not picked up by that time, Singapore's position as a market with traditionally low vacancy rates could be in trouble.

- CRE strategy will be reacting "twice" over the coming 12 months, with one gear shift to cost reduction and P&L preservation and a second move to address rapid return in business activity and headcount, which will unfold in Q3/Q4 of 2021. This will necessitate greater demand for agile workspace simply to respond to the market risk/opportunity.

Cash is King: 75% of our corporate clients surveyed are reducing CAPEX on workspace in the next year – the office market will produce more solutions that reduce the reliance on significant investment from the client.

- CRE will need to respond with new options that require limited CAPEX investment.

- The next stage of the post-pandemic era will be chasing profits after a year of flat growth (for many sectors). CRE strategy will evolve to view workspace as a value-generative, profit-enhancing tool that enables growth and development of business.

2. ADAPTATION

Shifting focus from property asset outcomes to personal experience

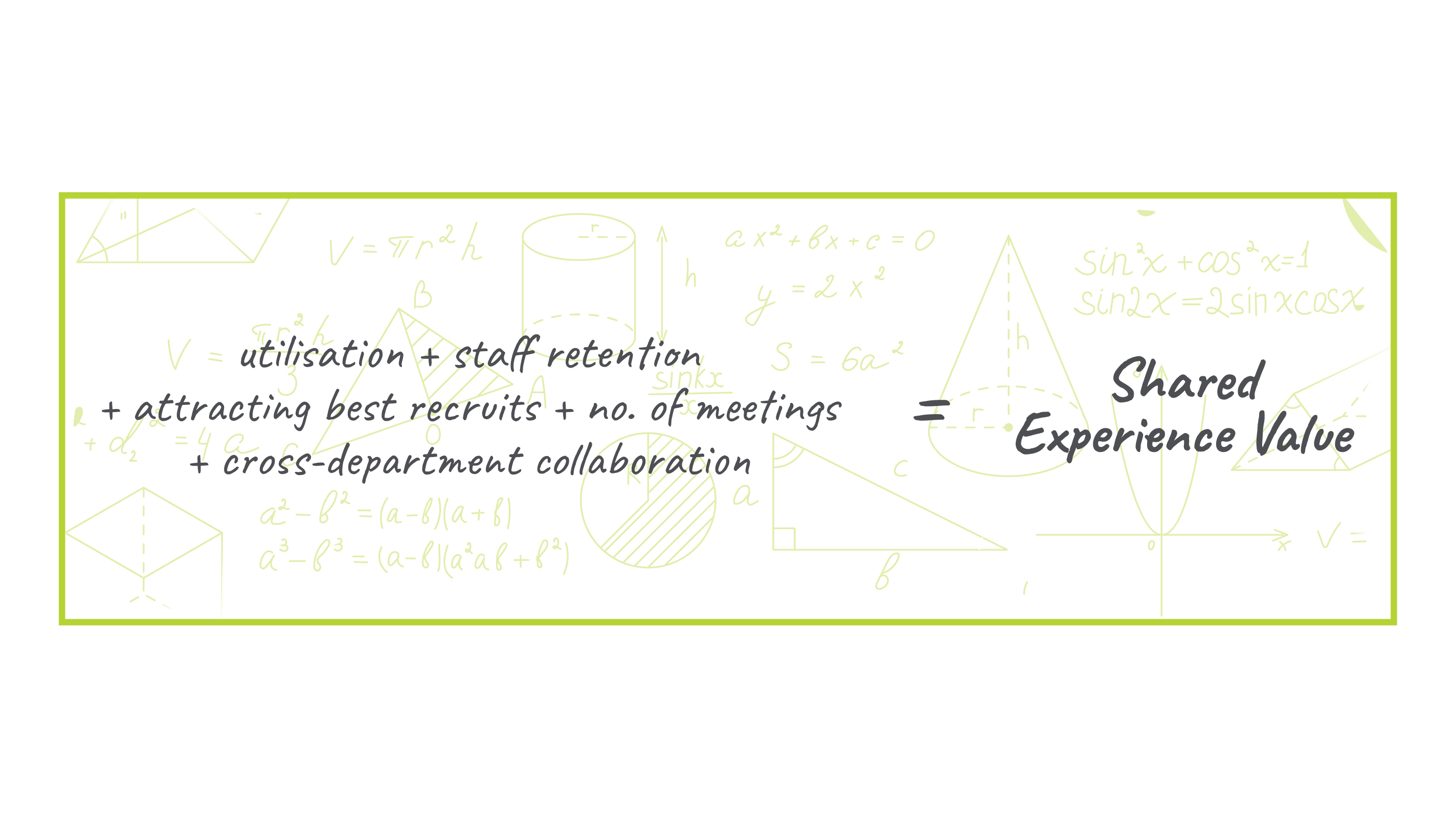

Future CRE leaders will drive the performance of the office portfolio against a wider set of goals around people, process and place. This will include new metrics founded on people-led outcomes that reflect broader value to the business such as “Shared Experience Value.”

- IT, HR and CRE will coalesce more closely than ever before. As the purpose of the office changes, so does the role of CRE professionals. 90% of CRE professionals Instant interviewed agreed, with the forerunners bringing in new disciplines to measure the success of a workspace. Office occupancy will move from passive attendance to purposeful presence. Our feedback from Human Resources Directors shows similar views.

- For the first time, we will witness a consumer-led response to the office, with employees voting with their feet on where and when they work. "What time am I going to be in the office today?", will be replaced by "Where and how do I want to work today?"

- CRE will have to offer safe access to a variety of options and factor in that the rigid nine to five might well be over, with staff choosing to mix working hours, to reduce the cost and discomfort of rush hours at the beginning and end of the working day.

- We expect to see a Shared Experience Value ascribed to the office. Using data, can we establish a methodology which allows companies to create a workplace experience that enables growth and development?

Staff wellbeing is already a key focus during the ‘return to work’ but will take on even more significance in the office of the future. Our survey of operators has flagged staff wellness being the key concern for prospective clients and this emphasis will only increase.

- Occupier research conducted by The Instant Group showed that space-related Covid-19 plans are the 2nd most vital feature of today's office. We expect this sentiment to evolve into broader health and wellbeing concerns with employers wanting not just plans but data to give confidence.

The focus of the central “hub” office will shift to collaboration and office footprints have to incorporate this change. This means more emphasis on collaborative design, better use of shared spaces and enabling reductions in portfolio size by as much as 40% in the short-term.

- Recent research conducted by Leesman found that those working from home struggled the most when sharing ideas, connecting to the organisation, and connecting to colleagues.

- With the workspace experience founded on the collaborative experience, this will facilitate a reduction in dedicated desks needed for the majority of staff in most companies.

- What is needed to foster collaboration? Is it as simple as reducing the number of desks alone? We are likely to see more spaces used for meeting rooms, open forum areas, break-out areas, sports and wellness facilities.

- Drawing teams back to the office is the key here and some companies may have to rethink the use and design of the workspace to deliver this, with quality being paramount both in terms of the space itself but also the experience for those using it. We are already seeing "conventional" office space drawing heavily from the amenity mix that has been seen in coworking spaces for some time to mix up the configuration of trad. offices.

- If hubs are used in this way, will there be an obligation to create an alternative workspace for different purposes? Focused-work – which is 65% or more of the average knowledge worker's day – will need a location that matches that requirement. For many workers in flats or house shares, home working simply doesn't meet that requirement. So dedicated areas for focus and concentration will become part of the mix with an onus on corporate CRE teams facilitating this mix.

3. COMPETITION

The corporate drive for agility will create competition in the office market and greater choice

CRE leaders are chasing agility in portfolios to match business planning. Landlords will adopt more innovative deal structures on shorter terms to stay competitive with agile flexible workspace offers.

- As clients look for solutions for shorter terms, it will become apparent that the conventional procurement process, from strategy to execution taking 12-18 months, is not fit for purpose.

- Clients will want solutions that achieve a quicker and easier route to market. This will see Landlords evolve their business models to more customer-focused formats including commercial commitments.

- In line with a W-shaped economic recovery, where CAPEX preservation is key and rapid growth is possible in the latter stages of -2021, delivery models for space will have to reduce time and cost of existing routes to market.

Despite the pandemic, many markets globally have shown increased demand for flexible workspace, and on shorter-terms. We forecast flexible workspace supply growth of over 21% in 2021 and a greater variation of end product than ever before as agile operators seek out new niche options in the market.

- Interest in agile workspace solutions has never been higher with CRE teams from large corporates continuing to look for agility. New leases in London continue to fall quarter on quarter with JLL reporting a 73% drop Q on Q in London in their most recent data.

- This will "re-version the traditional relationship between landlord, occupier and service provider with management agreements to run space coming to the fore. We are already seeing non-sector providers entering the market and anticipate this trend gaining momentum.

Clients are searching for higher quality workspace in regional and urban locations – this will drive more investment in regional workspace to improve the end product. We will also see consolidation in the flex workspace sector as operators with less funds are unable to keep up with this new demand.

- The regional markets in many countries will have to evolve their approach to incorporate more agility to capitalise on increased demand, or simply miss the boat thereby driving occupiers back to the city due to lack of viable/desirable space.

4. VARIATION

The office sector needs to provider greater variation of product

Just 60% of office portfolios will be fit for purpose by the end of next year. Future portfolios will be made up of multiple locations with balanced exit dates.

- To deliver true agility and remain responsive to change, portfolios will need to be made up of multiple locations with exit dates balanced across the portfolio. This appetite for inbuilt agility will drive occupiers to ask for more choice from a wider supplier base. Those suppliers that can't or don't want to deliver against these criteria will be left behind.

- There is a risk that clients will go for the easiest area of the portfolio to exit i.e. the flex licenses rather than unsuitable leases. This will leave their portfolios unbalanced and in the wrong locations for their workforce but is a seemingly inevitable element of the initial response to the Pandemic.

Demand from professional services, consultancy and technology firms has increased as a % of total demand over the last year. These firms have shown the need to be agile, facilitate collaboration and stay close to the client. Their adoption of flex will continue over the next decade.

- Our forecasts (8) point to a potential growth of flexible workspace supply of over 21% in 2021 making it a record-breaking year in terms of new supply.

- So far only 14% (5) of providers have indicated they have cancelled expansion plans with several providers already looking at new overseas markets to drive their continued growth. The market is on track to achieve 12.5% penetration in the UK and 2% in the US by 2023.

- Where is the growth coming next (based on Instant Offices market demand)?

- Pharma: massive growth in test and trace, innovation, and vaccination has led to increased demand for casual, semi-trained labour to innovate, test, and provide administrative support.

- Legal: The office is firmly embedded in the working culture and ethos of law firms, but can they retain and attract the best talent if they use the office less?

- Professional services: We are already seeing consultants take small amounts of flex space across the country, but will they have to stay close to their clients as they have always done?

- Public sector: there will be significant investment next year, particularly in the regions. Will the public sector look at innovating in the way it takes space and holds it?

But the market is still not working for some growth sectors such as pharma, life sciences and healthcare. Demand is up from these sectors but the level of deals that are closing less so. The flex market needs to adapt workspace to appeal to these firms of the future.

5. SPECIATION

PropTech will facilitate greater focus on end-user experience

CRE leaders need to harness technology that generates an aggregated view of workspace use, one that gives them a better sense of location, value and performance. This will underpin a more dynamic approach to the office portfolio and facilitate the introduction of more flex.

- Huge and diverse data feeds will need to be housed and dynamically (i.e. in real-time) interpreted via user-friendly handheld devices for end-users.

- The science and analytics of this data will become the fuel for corporates around helping to measure and support wellbeing & productivity.

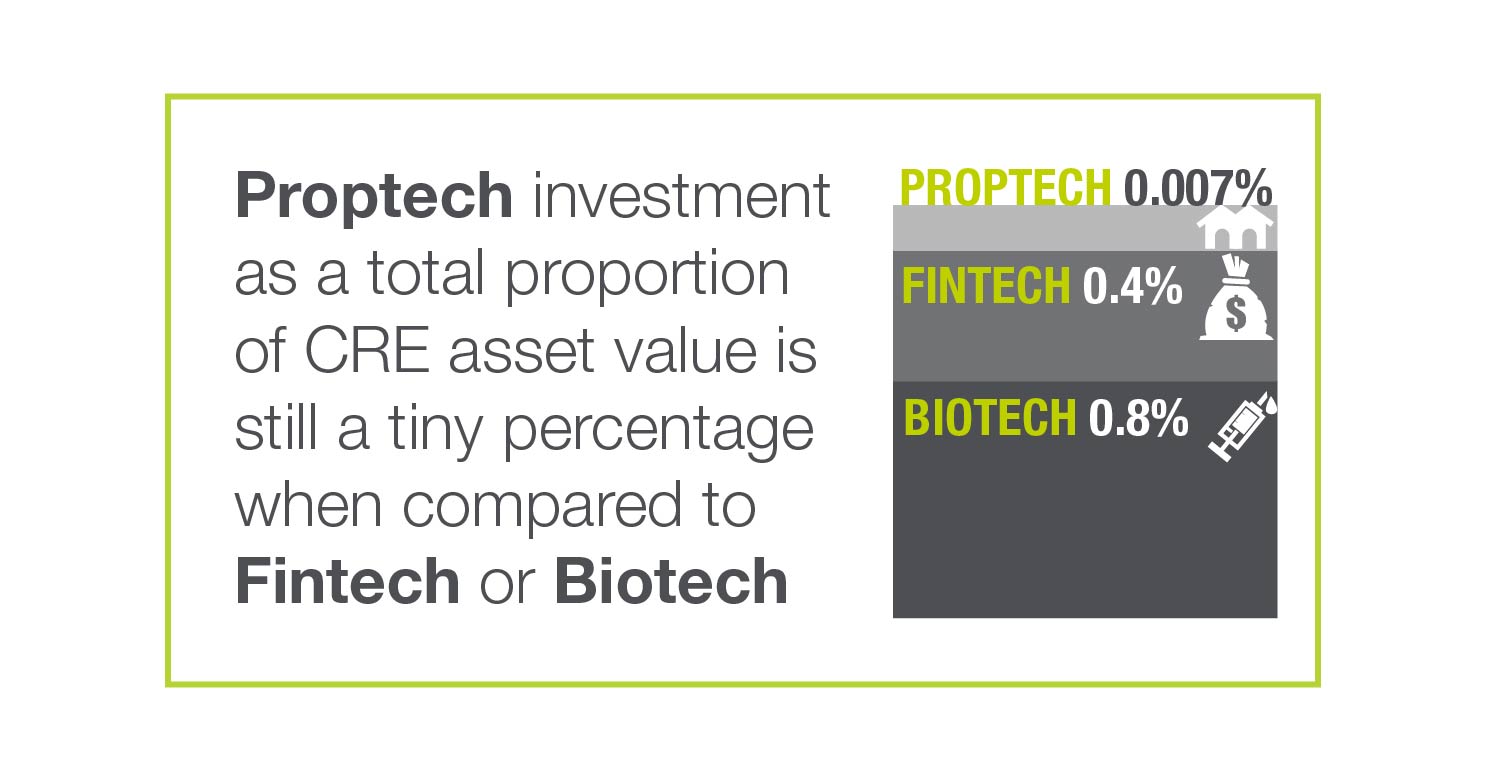

- Proptech investment as a total proportion of CRE asset value is still a tiny proportion when compared to Fintech or Biotech. Our sector needs to close the investment if it hopes to make the quantum leaps since in other sectors over the past decade.

Technology will become an essential part of the dispersed workspace infrastructure. A new species of occupier requires digital tools that capture costs, drive collaboration and bring 3rd party property spend into the procurement process.

- This will help put choice in the hands of employees regarding where and when they work but more importantly will join up mixed portfolios into one cohesive network.

- This is where Shared experience value comes in – how do you measure this against performance and track it against location? It will require a new approach to both the data collated from a workspace, but also the technology used to input that data and then meaningfully action it against the portfolio to derive insight and hence value.

- There are some existing solutions available but none have been used at sufficient scale to generate meaningful change or pull in enough data to boost smart-decision making. This will change.