So, you have decided to take flex space – what next?

The office market has spent the last five years changing radically. There are now other options. The choice has become less binary than a decision between lease or, perhaps, a serviced office space. There is now a plethora of options that in-house real estate teams and business decision-makers need to consider.

Flexible workspace is currently very prominent in the news – driven in part by the wealth of news coverage around coworking and WeWork. Business leaders are starting to ask new questions of in-house real estate leaders, “What about WeWork? Could we use that type of space? Do we have to sign a lease?” And it is not just the board asking questions, employees are asking managers, “Do I have to come to the office every day? Do you have any more locations? Can we take some other space?”

Agile, modern businesses are having to move fast. They need to react to their clients’ demands and competitors’ strategies. They need to move into new, global markets, put in place project teams as well manage existing office estates, with all of their expiry dates, space efficiencies, building issues, landlord demands and so on. They value pace and resilience but all at the right cost! But in a new market, with more options than ever before, surely the right choice is out there?

What choices are there?

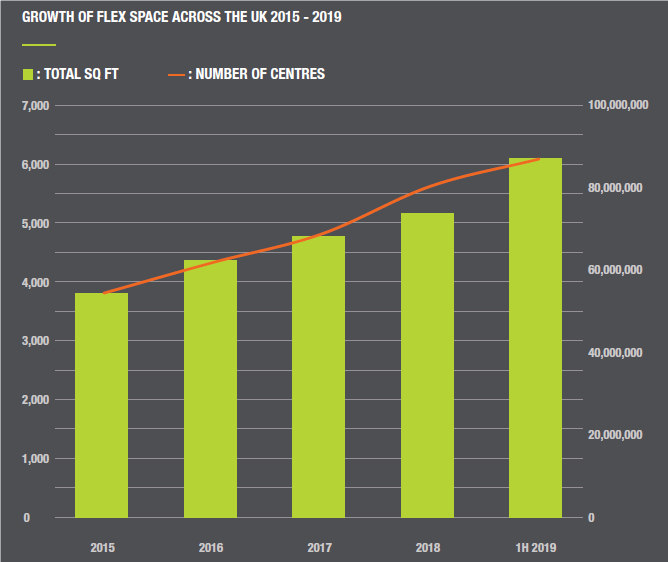

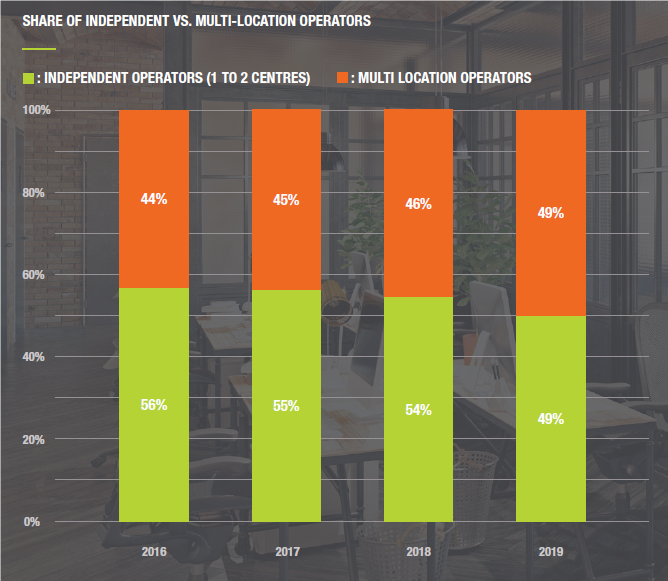

There are now 3,094 providers of flexible space within the UK, up from the 2,800 recorded in our last 2018 report. The variety of space available is overwhelming. During 2019 we have seen the rapid expansion of multi-location providers across the UK market. This figure represents 10.5% growth, a figure slightly below the overall centre supply growth figure.

The progression can be seen in companies such as Landmark, Citibase, WeWork and Spaces, which all now hold at least 1% of the UK market for the first time. While London has remained a focus for these companies, expansion has also moved to secondary cities. Cities such as Edinburgh, Cambridge and Birmingham have all seen new increased focus as demand continues to grow. But across the UK, these lead suppliers, including IWG and WeWork, only make up 7% of supply – there are many more options out there.

The choices facing real estate decision makers

For larger companies with in-house CRE teams and established real estate procedures, procuring flex space can pose a real challenge because of the differences with leased space. The reality is that many existing procurement agreements do not work for flex space. Here is what you need to consider:

- Procurement – often flex operators are unknown to in-house procurement teams, the contract takes time to negotiate as a result and may simply not match corporate requirements. So these in-house hold ups can slow down what is supposed to be a quick solution, making it difficult for CRE teams to react to business demands.

- Technology – it can be a challenge for CRE teams to engage with shared IT set-ups provided by flexible workspace operators. In fact, it is often a significant challenge for them to deal with their own in-house IT departments, so liaising with an external contractor can prove to be somewhat thorny. However, as corporate demand increases for flex space, the operators of this space are increasingly well versed in meeting the tech demands of businesses of all sizes.

- Security – furthermore there is corporate reticence relating to the close physical proximity to other firms and confidentiality issues that may arise, let alone cyber security in shared environments; coworking scares security advisors! Health and Safety can also probably be addressed under the same theme where corporate guidelines might be deemed incompatible with those of an operator.

- Marketing – workspace professionals are now increasingly concerned with brand and ensuring that the office environment clearly represents both design principles but also brand values. What is the point of bringing a workforce together in an office if they do not feel that they are working as part of a larger company ethos? CRE teams are going to have to find answers to this and work with operators on ensuring that their brands are depicted in a representative way.

- HR – a key stakeholder for CRE, the HR team is often driving the flex agenda to improve working environments (promote both collaboration and community) and to support the changing generational requirements from an office space. At the heart of this are the drivers of recruitment and staff retention linked to a corporate’s office space. Obviously, HR and the CRE teams have to work together to drive this agenda and the former now sees flex as the latest workplace concept that appeals to Gen Y or Z.

- Finance – in short, finance has a challenge understanding the flexible workspace approach though it provides an excellent opportunity to develop a more transparent cost modelling approach for commercial real estate. Finance departments have been very used to positioning leases off the balance sheet but the new IFRS regulations mean that they now sit squarely on the balance sheet.

- Who is in charge? – Both HR and IT are referenced above, and it is the “triumvirate” of HR, CRE and IT that need to rule the workplace. However, the role of “Caesar” is lurking in there and one will gain more prominence over the other two, probably dependent upon the emphasis within a specific corporate structure.

One issue that in-house teams have in common is that they are all under pressure for answers to this new market! They are therefore starting to redefine corporate policies and processes around real estate. They are having to work with supporting partner departments – IT and HR for example – and ensure additional engagement with clients to map out requirements to a rapidly evolving workforce. There is accordingly an increased appetite for data, and they are talking to third party flexible workspace advisors and operators. These are fledging relationships at this stage but they are taking root as the CRE market looks for answers.

What questions should you be asking?

CRE teams need to spend more time understanding the types of flexible workspace solutions available, whether that is coworking, serviced or managed offices. They also need to define how these spaces will fit their office requirements – project spaces, rapid office moves, portfolio consolidation gaps, entry into new markets, improving general portfolio flexibility, scalability or quality of space.

They need to take a look at the flex workspace market and the advisors who work within it, and how they can work alongside their existing CRE consultants. Then they can start to work up the business case for flex space and how flex solutions can be introduced into BAU real estate planning processes. This will then allow in-house teams to answer in a considered fashion whether flexible workspace is really a fad or a long-term solution for their business.

The in-house skill set is going to have to adapt to requests from the business to change and their language will have to become more inclusive of the holistic business rather than rooted in the property world. They are going to have to become conversant and comfortable with their HR and IT peers, and in many places lead them to the right solution – with the variety and increasing volume of choice this will be challenging yet very rewarding!