So, you have decided to take flex space – what next?

The office market has spent the last five years changing radically. There are now other options. Lots of options!

The choice has become less binary between a lease or, perhaps, a serviced office space. There is now a plethora of options that business decision-makers need to consider.

Flexible workspace is currently very prominent in the news – driven in part by the wealth of news coverage around coworking and WeWork. Business leaders are starting to ask new questions of in-house real estate leaders, “What about WeWork? Could we use that type of space? Do we have to sign a lease?”. And it is not just the board asking questions, employees are asking managers, “Do I have to come to the office every day? Do you have any more locations? Can we take some other space?”.

Agile, modern businesses are having to move fast. They need to react to their clients’ demands and competitors’ strategies. They need to move into new, global markets, put in place project teams as well manage existing office estates, with all of their expiry dates, space efficiencies, building issues, landlord demands and so on. They value pace and resilience but all at the right cost! But in a new market, with more options than ever before, surely the right choice is out there?

What choices are there?

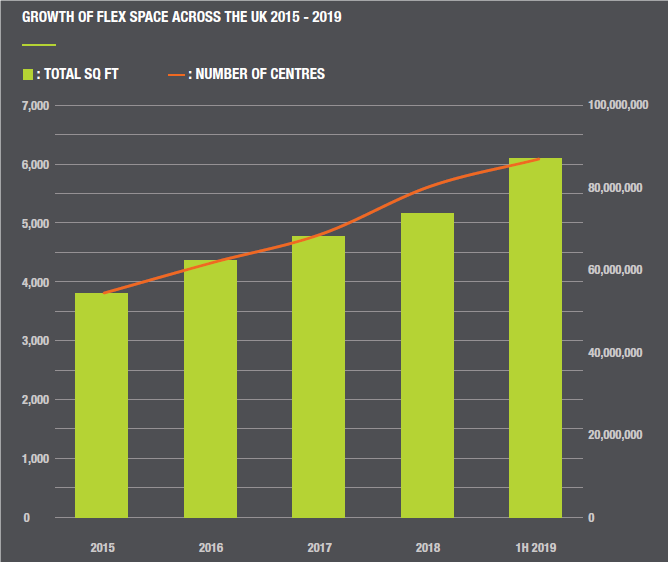

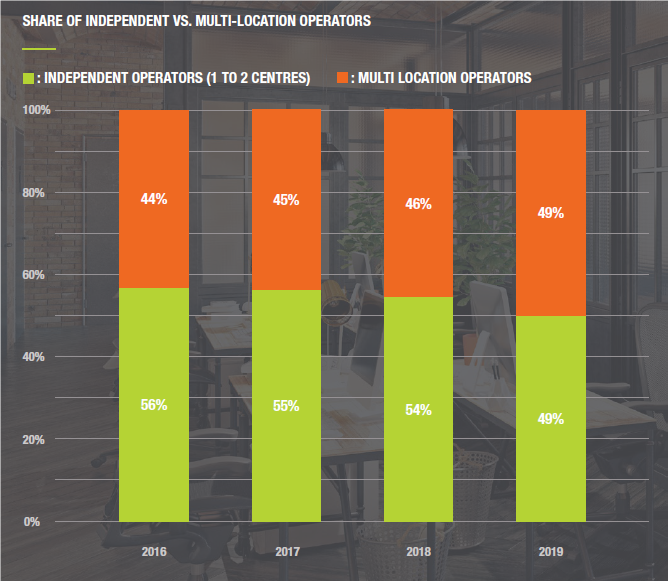

There are now 3,094 providers of flexible space within the UK, up from the 2,800 recorded in our last 2018 report. And more than 6,000 centres to choose from. The variety of space available is overwhelming. During 2019 we have seen the rapid expansion of multi-location providers across the UK market.

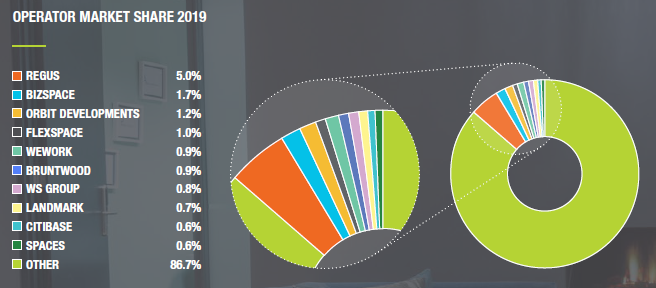

The progression can be seen in companies such as Landmark, Citibase, WeWork and Spaces, which all now hold at least 1% of the UK market for the first time. While London has remained a focus for these companies, expansion has also moved to secondary cities. Cities such as Edinburgh, Cambridge and Birmingham have all seen new increased focus as demand continues to grow. But across the UK, these lead suppliers, including IWG and WeWork, only make up 7% of supply – there are many more options out there from independent operators.

- Global demand for flexible office space has grown 50% in the last 5 years.

- Enquiries for >20 desks have grown year on year by 50%.

So, if you want to choose the best space for your business, what are the criteria you need to base that choice upon?

How to choose between a leased office or flex space…..? 16 Questions you should base your decision upon:

- Do you have the cash in the business to cover the upfront capital expenditure required to take on a lease? These costs commonly include:

- Hefty upfront rental deposits required dependent on covenant strength (business profitability/ stability)

- Often between 3-9 months rent will be held as a deposit

- Fit out costs – partition walls for meeting rooms, kitchenette, office storage, furniture, printers etc

- Agent fees - typically 10% of one year’s rent

- Legal fees - paying lawyers to prepare the contracts

- Is there a particular deadline or business timeline the project has to adhere to? In short, how fast do you need the space or, to put it another way, how much money is it costing you to have the team elsewhere? The process of acquiring a lease and fitting out the space ready for occupation typically takes between 3 – 6 months.

- If a client is unsure of its long-term future head count, can it commit for 3 years? In these economic and politically uncertain times most businesses should want flexibility, especially as a lease now sits as a liability on a company’s balance sheet. With most conventional leases the term will be a minimum of 5 years, potentially with a 3-year break.

- And then there are exit costs, or “dilapidations”: this is a cost that needs to be accrued for over the term and it is the cost of returning the office to the original condition it was taken. E.g. paint walls, remove partitions and replace carpet etc. This can be a costly exit amount.

- What are the business objectives behind the move – do you have a particular growth strategy in place? What is the short, medium and long-term value for re-location?

- What systems does your business require to function, especially IT Systems? Secure server requirements, maintenance and accessibility? Do you have an IT expert that can deal with any internet issues or technical problems? If not, what happens if the internet goes down? This will require hiring outsourced IT to provide support. Another cost!

- What if something goes wrong with the business? The entity signing the lease is legally responsible to pay the rent for the full duration of the term. They can attempt to assign the lease to another business but there are no guarantees they will find a replacement tenant. It’s a big liability!

There are many other “hidden” costs of leased office occupation that are not included in the price per sq ft that is quoted to clients. These include being responsible for arrangement and payment of office cleaning, maintenance, mail handling, office facilities management e.g. broken printer/broken coffee machine/leaking sink etc.

In short, it’s a lot more labour intensive to run your own space - is there someone in the company that is prepared to take on this responsibility?

- What should customers think about when procuring flex space? The expansion in flex space has given clients so many exciting choices, but it is now more important than ever to choose the right space for your business. Also, given that it is priced very differently to a traditional lease, what are the considerations you should bear in mind when looking for your next option?

- What is the rent increase in year 2? This is not the same for every operator of flex space but many of them, particularly in areas with less supply, will include rent increases in the second year of the contract. Look out for this in your agreement but also be aware of the pricing mechanisms in the market – do your research to understand whether there is more supply coming into the market, how old is the centre, are their margins under threat? Find out what your negotiating position is before entering into the deal.

- What type of operator are you working with? One of the larger operators may have enough space to allow your fast-growing business to expand within the existing centre. Or they may have another location close by that can cater for your growing team. Find out what your options for expansion are before you sign the contract. Furthermore, if your company is expanding globally, could they help with international space – a global connection can massively reduce the hassle and risk of opening a foreign office, as well as reducing paperwork. Is this operator suitable to partner with, in terms of supporting my growth as a start-up? (Have they been around for a long time, or are they a pop-up operator looking to sell etc.)

- Another important consideration is additional meeting room costs – many centres now have a lot of desks and considerable shared amenity space such as meeting rooms. Some centres (though not all) will charge for the use of meeting rooms. Understand better what these costs are, how they may change over time and how many other companies your business will be sharing the space with.

- Working within the brand of some operators can be an issue for some clients. If you have invested heavily in your marketing and establishing a brand culture, you will want to be able to show it off to your clients. Similarly, if you are growing a scale-up business you will want your team to develop in a space that reflects your brand values. To that end, can you put your brand in their space and change the look and feel? Many operators have invested heavily in their space and can be very reluctant to adapt to client requirements. This is a critical consideration that needs to be investigated before contract discussions begin.

- Moving office is definitely the right time to take stock of company culture and decide how the new space can benefit staff attraction and retention. What is the recruitment pool like in the surrounding area, and who will you be competing with? Take a look at the types of space your competitors are in to gauge the benefits to your business of investing in a premium brand.

- How does the configuration of space work for your business? Are you going to introduce agile working? Does your team have daily stand-ups and need additional meeting space that will not disrupt other team members? The way companies work now is very different to a decade ago and the newer generations joining the workforce are very comfortable in collaborative, agile environments. Will the space cater for them and can you introduce more quiet areas for concentration if your team work on a lot of focus-orientated tasks? Remember, many operators are willing to work with you to generate the types of space that can really help your team and business thrive.

- The vast majority of spaces now come with fantastic amenities – anything from yoga studios to cinemas, coffee bars to fitness studios. But what does your business really need and what are you paying a premium for? Flex operators have innovated in this area particularly over the past five years and there is so much choice available now. So what amenities are worth the increase in desk price and which are simply a novelty, which your team will never use. And definitely look out for any hidden costs for additional services that may come up as over a three-year term, they could really add up.

- There are so many different types of space now available. What does a shared building with your own private office offer over a small self-contained space with no communal environments outside your demise.

At the Instant Group, we offer our clients the choice of an aggregated market view. For clients, this resonates as a transparent, cost-effective approach to the workspace conundrum and we work very hard to ensure that the market works for them and they have access to as much choice as is relevant for their business.