When measured against pre-pandemic levels in 2019, demand for flexible office space in Brisbane has shown an 8% improvement, though overall demand witnessed a 1% drop in 2022 compared to 2021.

Global workspace innovation firm The Instant Group, whose digital platforms constitute the world’s largest marketplace for flexible workspace solutions, analyzed 2022 demand, rates, and supply for the Greater Brisbane area.

Demand for flex office space in Brisbane was up by 8% in 2022 when compared to 2019. Activity and occupancy in the city has recovered well since the pandemic, driven largely by the trend of bigger companies and multinationals shifting from traditional leasing models to flexible ones. Overall demand for flex office space witnessed a one per cent drop, however, in 2022 when compared to 2021.

"Last year, demand for flexible workspaces in Brisbane fluctuated due to the uncertain market conditions caused by Covid-19. Some businesses reduced their footprint, while others sought out flexible workspace solutions. This resulted in a volatile market with changing demands and preferences,” said Jordan Cui, Associate Director at The Instant Group.

"Currently, demand in the Brisbane market is picking up while supply is increasing on the fringes. At Instant, we are working with several multinationals that are looking to move from commercial tenancies to flex where their main focus is on the amenities that an operator provides," added Cui.

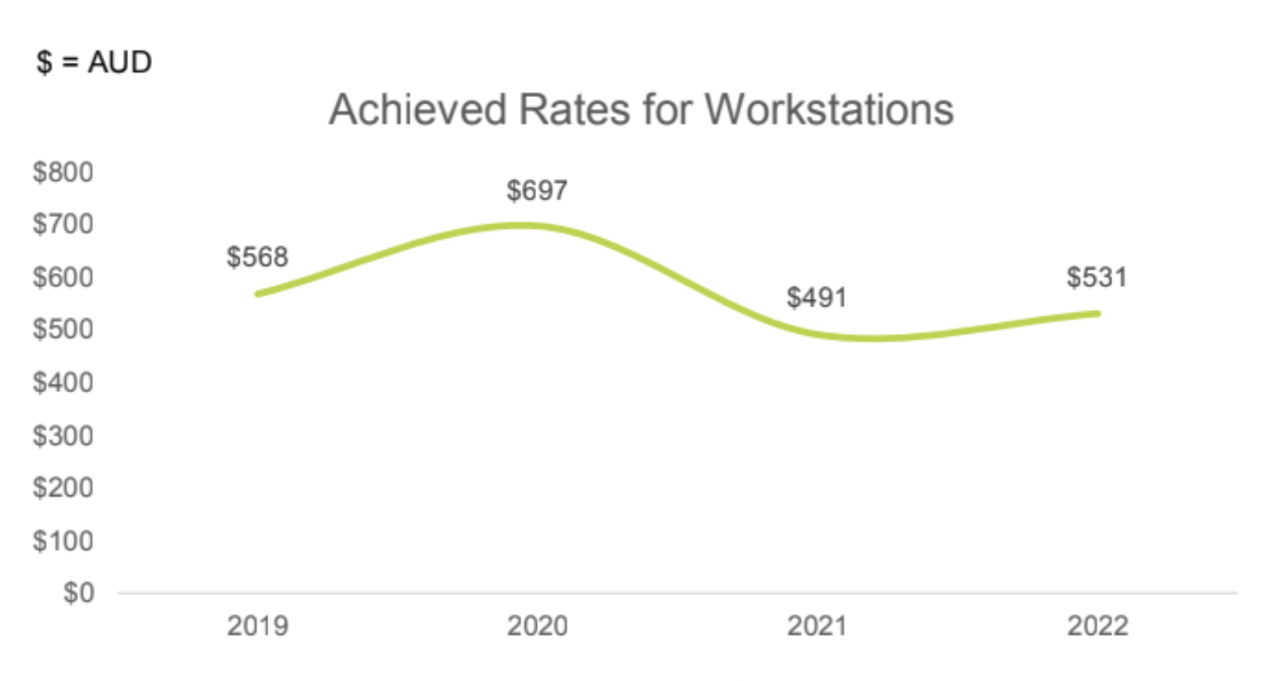

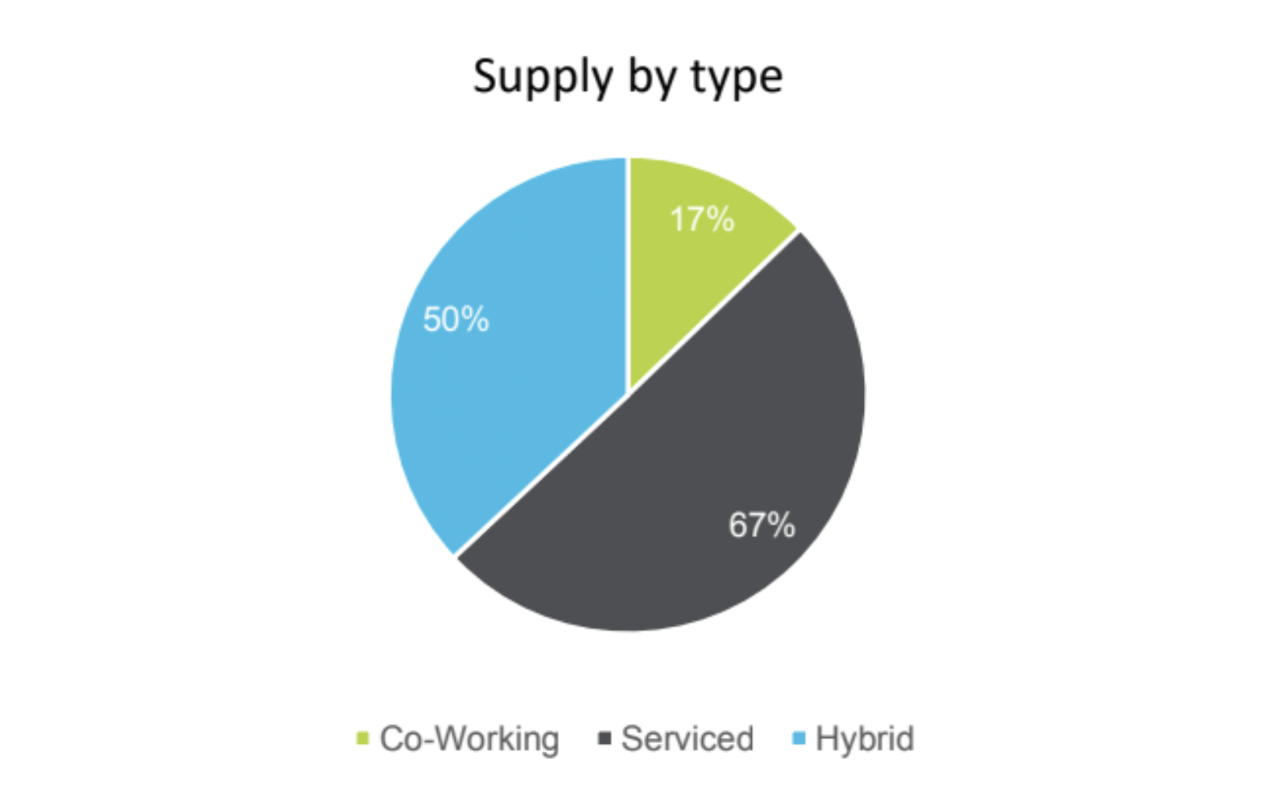

There was a 14% growth of new flex spaces (supply) within Brisbane in 2022 when compared to pre-pandemic levels, while rates for workstations increased by 8% in 2022 when compared to 2021.

This can be explained by inflationary pressures, which has resulted in many operators increasing their prices.

________________________

Methodology

The included data is compiled via The Instant Group's leading flexible workspace data platform, Instant Insight. Rate data is based on transacted rates, providing the most accurate view available within the industry, while demand data is based on demand coming through The Instant Group's digital booking platform, Instant Offices. Percentage change is based on relative change.