What are the "hottest" markets for flex? Analyzing the top 10 markets for flexible office spaces in 2023, we examine year-over-year fluctuations in demand, with data revealing notable demand spikes in Mexico City, Riyadh, Colombo, Sydney, and Dubai.

Like every industry, the office and commercial real estate (CRE) sectors have gone through major post-pandemic shifts. The flexible office market in particular has faced varying highs and lows in terms of supply and demand, with some cities witnessing a healthy recovery, and others struggling to maintain steady levels of occupancy or enquiries.

Of course, these city-by-city fluctuations are demonstrative of a larger trend: the global flexible office market is maturing and will continue to do so in the coming year.

Market maturation will require key players, such as landlords, operators, and investors, to understand the changing dynamics of flexible office demand. By using reliable insights and market data, business leaders can make more informed decisions that improve the efficiency of their workspaces.

An analysis of our “hottest” markets from 2023, meaning the cities where we saw the highest total number of flexible desks requested, proves that demand is indeed rising across several key markets—some of which are newcomers to the scene.

Here are the 10 cities that saw the greatest number of flex desks requested in 2023:

1. London, England

2. Mexico City, Mexico

3. Riyadh, Saudi Arabia

4. Dubai, United Arab Emirates

5. Sydney, Australia

6. Chennai, India

7. New York City, New York, USA

8. Colombo, Sri Lanka

9. Singapore, Singapore

10. Berlin, Germany

When looking at this list, certain cities have become synonymous with coworking and flexible workspaces for years, such as New York City, London, and Sydney. However, many of the cities on the list are demonstrative of flex taking hold in new markets, like in Riyadh, Colombo, and Mexico City.

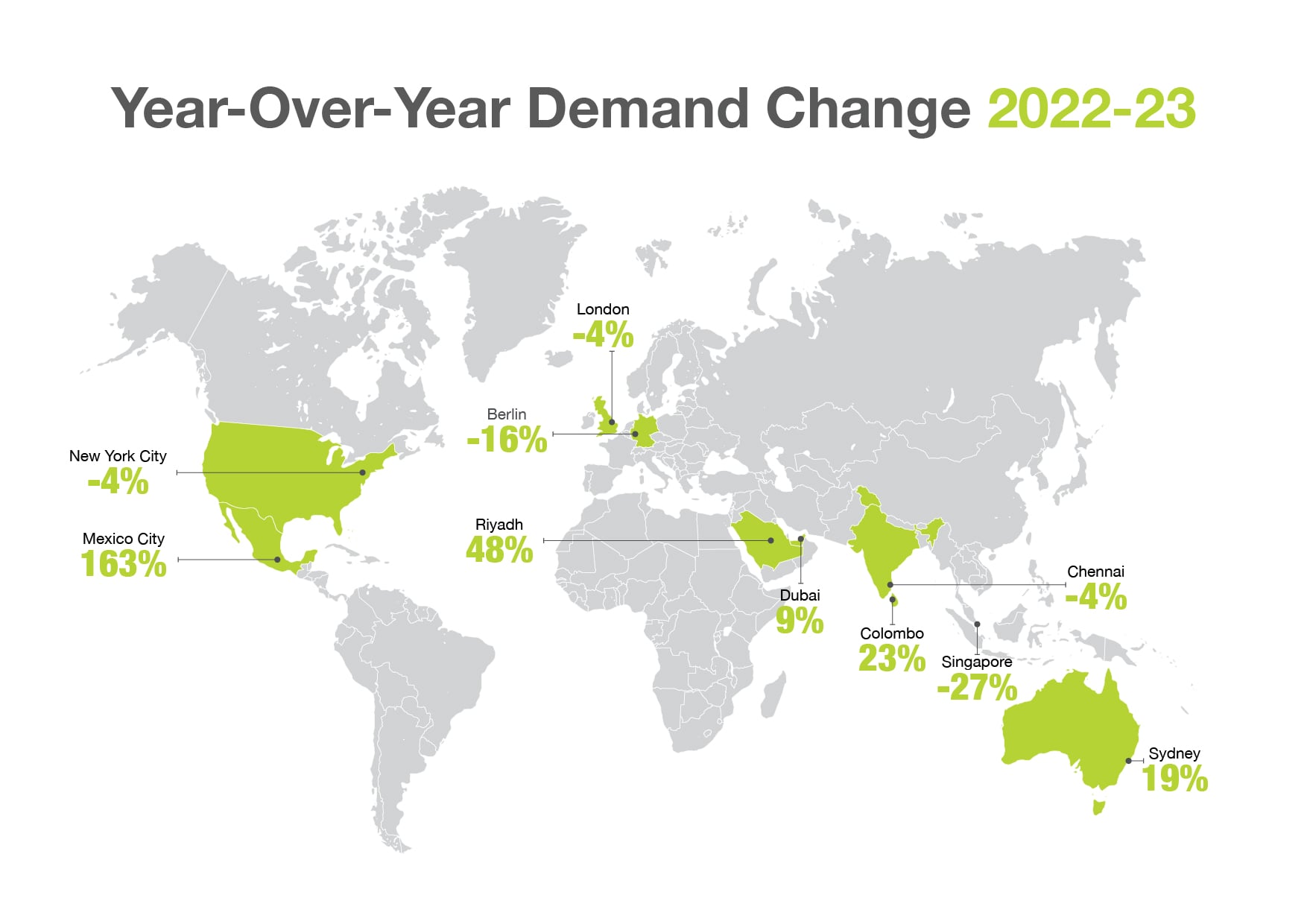

YEAR-OVER-YEAR FLUCTUATIONS FOR 2023'S TOP MARKETS

Going one step further, analyzing the year-over-year percent change in demand across these markets presents an interesting opportunity to really understand where flex is booming.

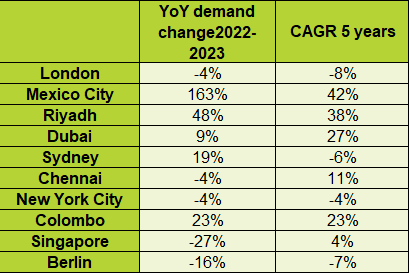

As illustrated in the chart, only five of the 10 hottest markets saw demand increase between 2022-23 — Mexico City (+163%), Riyadh (+48%), Colombo (+23%), Sydney (+19%), and Dubai (+9%).

This massive jump in demand in Mexico City speaks to the city’s bold recovery from the pandemic, propelled by factors such as nearshoring, cost savings, and the market’s top quality operators with plenty of capacity for large enquiries.

Although half of our top 10 hottest markets experienced a decline in total flex desks requested over the past year, this is not always an indicator of a market that is still struggling to regain its footing from the ramifications of the pandemic. Several markets experienced a ‘post-Covid bubble’ in 2021 and 2022 and demand is now re-adjusting to pre-Covid growth levels.

A FIVE-YEAR VIEW: WHERE IS DEMAND CONSISTENTLY HIGHEST?

This is the case for Chennai and Singapore, both of which experienced extremely high demand growth in 2021 and 2022 respectively. Although demand has dropped over the past year, the compound average growth rate over the past five years is still positive - +11% in Chennai and +4% in Singapore - indicating that current demand levels are still above those seen pre-pandemic.

Several cities in our top 10 list witnessed massive increases in demand for flex in 2022. Cities such as Colombo (+111%), Mexico City (+135%), Riyadh (+138%), and Singapore (+126%) ballooned massively, each surpassing an +100% increase in flex desk inquiries.

These increases were largely driven by a surge in demand for flexible solutions from larger companies looking to inject greater flexibility into their real estate.

What this data illustrates is that the flexible office market is indeed maturing, with many cities continuing to see gradual demand growth after the initial post-pandemic spike in 2022.

Ultimately, this progress can be seen as a positive sign of recovery for the industry, which cannot be defined by one trend or timeline. Rather, the industry is constantly evolving, with office demand impacted by wide-ranging variables, such as economic conditions and worker demographics.