Increased requirements for carbon reporting is causing the amount of stranded assets to rise, leading to new pressures for each part of the CRE value chain. How can operators make sure their workspaces are part of the solution, rather than the problem?

By: Mike Bascombe, Principal Consultant at Incendium Consulting

One of the only certainties available to business in 2023 is that sustainability regulations are becoming more demanded and more complex.

The market will bear this out through a direct correlation between the increased requirement of carbon reporting and rising numbers of stranded assets. These rapidly and unexpectedly devalued properties are left in the wake of two forces: rapidly evolving regulation and reporting requirements, and the pressure from occupiers who need sustainable supply chain partners.

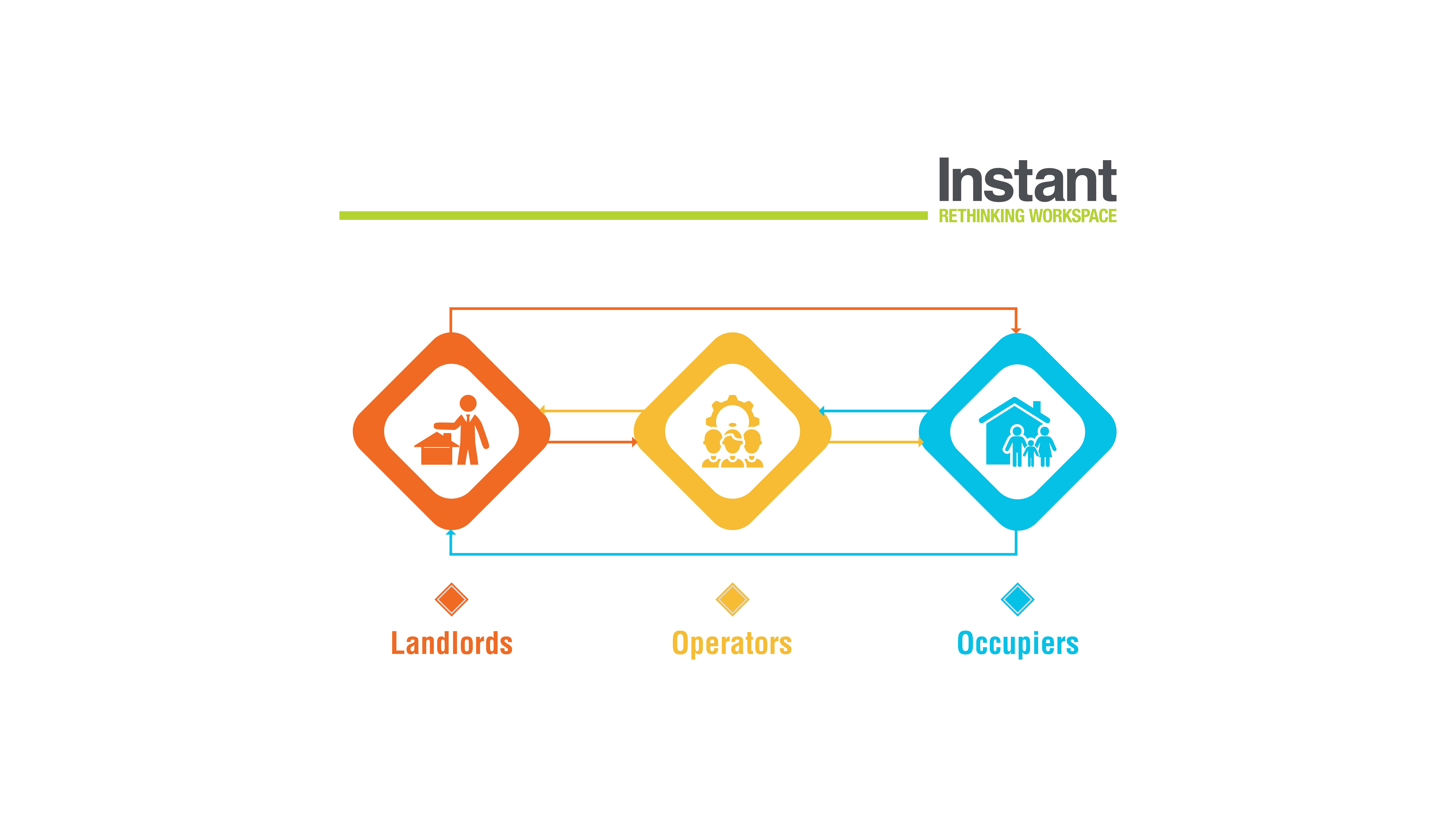

Operators can find themselves squeezed in the middle. Without adaptation, they will find their properties untenable in a sustainability focused economy.

___________________________

DEMAND

The pressure to operate sustainably is being driven by governments through regulation, investors through cost of green finance, and consumers by voting with their wallets and allying their working life to companies whose values match theirs.

As more of the value chain is captured within reporting requirements and ambitious Net Zero targets, our workplaces must be part of the solution at a corporate level. Otherwise, properties won’t be able to meet occupier demands and will lose out on new clients, leading to even more stranded assets.

If we trace the commercial real estate (CRE) value chain from start to finish, demand ultimately flows back from occupiers.

As businesses adopt Net Zero targets, they also adopt the GHG (Greenhouse Gas) Reporting Protocol. This has been designed specifically to capture supply chain emissions in Scope 3, which are the result of activities not owned or controlled by the reporting organization.

Since operators and landlords are key parts of the CRE supply chain, the pressure to provide sustainability-related data among them is rising quickly. As regulation forces more occupiers to adopt Net Zero, this pressure builds throughout the value chain and key business decisions will hinge on whether partners can be part of the solution or not.

___________________________

COMPLEXITY

In addition to the pressures on value chains, sustainability regulations are also leading to greater complexity in reporting which varies by country.

The International Sustainability Standards Board is now including Scope 3 disclosure in climate accounting standards. Companies in the UK are already required to report on Scope 1 emissions relating to their operations, and on Scope 2, relating to their energy consumption.

The U.S. Securities and Exchange Commission (SEC) is also setting ambitious Net Zero and CDP requirements for government suppliers. Moreover, TCFD and CDP disclosure are now legally required in Switzerland.

The picture is clear: sustainability reporting is soon to be universally mandatory for businesses. For operators and landlords, this equates to supplying electricity and gas consumption along with details about renewable energy in a way that can be used for occupiers’ reporting needs. Even supplying this basic data can be a challenge, but this is the bare minimum occupiers will come to expect from supportive members of their supply chain.

Disclosing Scope 3, however, is where things get interesting. Capturing emissions, or at least the data to calculate emissions with any semblance of accuracy, will be driven by collaborative efforts from all parts of a business. Both internally and externally, companies will need to develop the flow of data from internal business functions like procurement, and externally from individual suppliers.

The methodology behind calculating Scope 3 is constantly evolving from a company’s perspective. It often starts with spend data, like how much is spent on each supplier annually.

Suppliers are then categorized, and an emission factor is allocated to them. This is multiplied by the spend to reach a tCO2e amount. The current process is clearly full of holes and an approximation at best. Thus, truly accurate calculations will require a deeper dive by suppliers and drive them to produce more adept carbon profiles for all parts of their operations.

___________________________

Very quickly, businesses will come to a situation where they are either part of the solution, or not. Those who aren’t will find it increasingly challenging to find occupiers willing to compromise on their own sustainability credentials for the operator or landlord’s benefit.

The workplace is such a crucial part of the sustainability conversation that it cannot underperform. Operators and landlords that move quickly enough to bake sustainability into their operations and ensure assets are a data point that makes sense to occupiers will see a sizeable market advantage as these pressures come to light. The time to act is now.